Blog

How to Read Legalese: Making Sense of the Key Terms in Revocable Trusts

Trusts are usually lengthy documents that can be difficult for non-lawyers to understand. In this blog post, I'll explain the key terms and provisions so that you can "translate" what your Revocable Trust document says.

Key Terms

The Settlor is the person who created the trust. Some attorneys use the term donor or grantor, but they all serve the same purpose. It's simply the person who created the trust.

Next is the Trustee. The trustee is the person in charge of the trust and is in charge of making sure that the trust provisions are being implemented, and that the trust assets are being managed appropriately. Sometimes the trustee is also referred to as a fiduciary, but fiduciary is a more general term that describes anybody who's appointed to do a job for you. Other examples of fiduciaries are an executor under a will, an agent under a power of attorney, or a health care representative under a health care directive. A trustee is just another type of fiduciary. In many instances, the settlor and the trustee are the same person. It is also possible to have co-trustees (i.e. two or more people or institutions serving together as trustees).

The next person that you're going to want to be on the lookout for is the Beneficiary. The beneficiary is the person who's entitled to receive distributions from the trust. And just as the settlor could be the trustee, the settlor can also be the beneficiary. Thus, it is entirely possible for someone to be the settlor, trustee, and beneficiary of a trust.

It is important to note that there are many different types of trusts that can be used for estate planning purposes. One of the most common of these is the Revocable Trust. The word revocable, as the name implies, means that the person who created the trust (the settlor) can always revoke, amend, or modify the trust at any time. One of the primary benefits offered by a revocable trust is that assets owned in trust avoid passing through probate upon the settlor’s death.

Another frequently used type of trust is the Irrevocable Trust, which is the exact opposite of a revocable trust. It's a trust that, once implemented, can never be modified, amended, or revoked. While these trusts are very inflexible, they can still be a valuable estate planning tool as they can protect assets from long-term care costs and other types of creditors.

Key Provisions

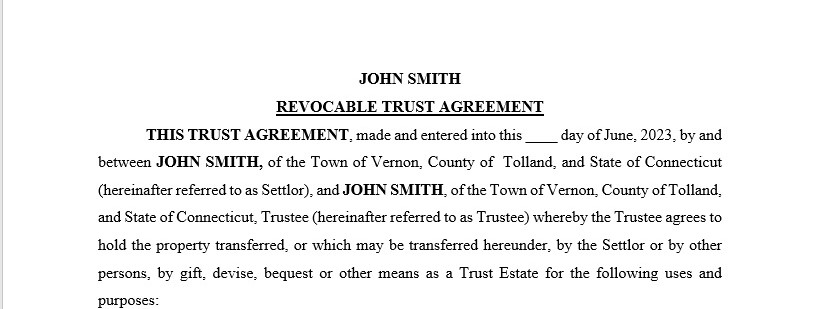

The first key provision you should look for is the one that states the name of the trust, the identity of the settlor, and the identity of the trustee. In most instances, this provision is on the very first page of the trust. Below is a sample of the section of our revocable trusts where we state that information.

Another of the key provisions is the Lifetime Distribution Provision. To use a revocable trust as an example, these trusts usually allow for the settlor to have access to the trust owned assets during the settlor’s lifetime, but there needs to be specific rules for how and when the trustee can distribute the assets out of the trust to the settlor/beneficiary and how the assets that are not being distributed are to be managed. Many times these rules aren't very restrictive and may provide that the assets can be distributed to the settlor, to the settlor's spouse, or to the settlor's descendants - children and grandchildren - pretty much without restriction

The next important section is going to be the Distribution Provisions Upon Death of the settlor. Once the settlor passes away, does the trust terminate and all the assets pass outright to the spouse or pass outright to the children? Or will the assets stay in trust and continue to be managed for the benefit of the spouse and/or children? That's all going to be spelled out in those distribution provisions upon the settlor's death. In the event assets are to continue to be held in the trust, you will likely see paragraph headings such as “Family Trust”, “Marital Trust”, or “Children's Trust”. Under these headings you will find additional provisions that provide rules for how those trusts are to be managed by the trustee until they terminate (usually either upon the trust beneficiary’s death or upon the trust beneficiary reaching a certain age).

Last but not least, you're going to want to look for the Appointment of Successor Trustees. At some point during the settlor’s lifetime, he may no longer be able to be the trustee because he's become incapacitated in some way. Or upon the settlor’s death, a successor trustee will need to take over to either distribute the trust assets (if the trust is terminating) or continue to manage the trusts assets (if there are ongoing trusts). For this reason, most trusts will appoint a person or institution (i.e. “corporate trustee”) to take over as successor trustee.

If you have questions about revocable trusts or any other estate planning documents, or would like to set up an appointment an estate planning attorneys, call us at 860-646-1974.